A Property Protection Trust is designed to help and protect your property from creditors including an assessment for long term care fees.

Our Property Protection Trust will ensure that your estate is kept intact by protecting your share of your home (or other property, if required) or the value in it.

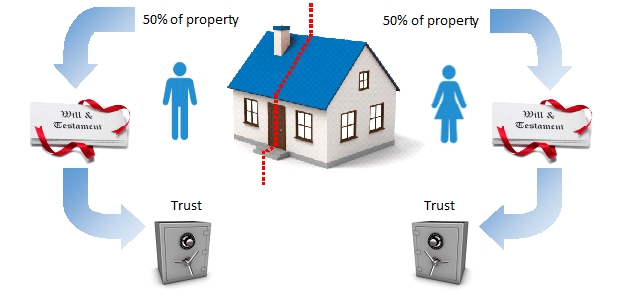

We do this by firstly changing Joint ownership of the property to Tenants in Common, usually each owning 50% of the property, this then enables you to “Will” your share to your chosen beneficiary via your Family Trust.

By leaving your share of the property in a Trust with a life interest to your partner/spouse you safeguard your assets from being lost should your partner re-marry, or be diluted if that partnership ends in divorce. It also protects the trust property from bankruptcy and care costs in later life for the surviving partner.

Importantly the Trust also protects the interests of the survivor, allowing them to live in the property until their death, (or, if required, until they cohabit or remarry). If the survivor then goes on to remarry, they cannot leave the whole of the property to their new spouse, as a portion is already owned by the Trustees on behalf of the chosen beneficiaries. The survivor can also move house if they so wish, using the whole of the proceeds towards another property, or raise capital by purchasing a smaller property, a greater proportion of which will then be owned by the Trustees.

- Typical Example

On first death, the Deceased’s share of the property is passed into their Trust via the Will. The surviving spouse/ partner continues to live in the property and is still able to move home if they choose to do so.

In the event that the survivor enters Care, the survivor only owns a half share of a house

- Benefits

Care

Holding the assets in the Trust ensures that they do not add onto the Beneficiaries’ own estates and so cannot be assessed for their Care cost

Marriage After Death

Placing half of the family home and other assets into a Trust on first death ensures that, should the surviving spouse/partner marry in the future, those assets cannot

be taken into the marriage and removes the threat of your own children being disinherited. The survivor is still able to use the assets in the Trust.

Creditors or Bankruptcy

Similarly, if any of your Beneficiaries are subject to Creditor Claims/Bankruptcy then their inheritance would not be exposed to these claims.

Divorce

Placing the assets into Trust ensures that, if your children/ chosen Beneficiaries are subject to Divorce proceedings then what you intended them to receive is protected from any Divorce settlements.

Further or Generational Inheritance Tax

Holding the assets in the Trust ensures that they do not add to the Beneficiaries’ estates and impact on their own Inheritance Tax

Residence Nil Rate Band (RNRB)

Our trusts ensure that if there are lineal descendants as beneficiaries, the trust will still qualify for the RNRB.

Remember that making a basic double Will only guarantees what happens on 1st death

Without the correct planning, some or all of your children’s or grandchildren’s inheritance could be lost. However, with a few simple strategies we can protect you and your family from needless expense and worry.

Consider the Facts…

- Everyone should have a Will, but 2 out of 3 people have not yet made a Will and those that have, may not have the correct Will in place.

- 40,000 people a year have to sell their home to pay Care Fees.

- 50% of women and 33% of men will need long term residential care.

- The average cost of residential care in the UK is over £32,000 per year.

- A large proportion of any inheritance is lost in future divorce settlements, to creditors or bankruptcy and unnecessary taxation.